Midsommar Impact Brief Edition does a deep dive into the new ISSB standards released earlier this summer. In a world increasingly (hopefully) concerned about environmental, social, and governance (ESG) issues, and businesses impact on the world, just in time for a blistering summer global reporting has taken a significant step forward with the release of the International Sustainability Standards Board's (ISSB) standards, known as IFRS 1 and IFRS 2.

In this edition of the Impact Brief, we explore how these standards fit into the historical context of existing frameworks and regulatory bodies, and their implications for global reporting and the advancement of sustainability practices in businesses.

Thanks for reading Impact Brief! Subscribe for free to receive new posts and support my work.

These standards aim to harmonize sustainability reporting, providing a universal framework for organizations worldwide. Their introduction marks a turning point in global reporting practices, as they contribute to a more transparent and accountable approach to sustainability.

" The ISSB Standards have been designed to help companies tell their sustainability story in a robust, comparable and verifiable manner. We have consulted closely with the market to ensure the Standards are proportionate and will result in disclosures that are relevant for investment decision-making." - Emmanuel Faber, ISSB Chair

The International Sustainability Standards Board, part of the International Financial Reporting Standards (IFRS) Foundation, has designed IFRS 1 and IFRS 2 to establish a common language for reporting organizations' sustainability performance. These standards build upon existing sustainability reporting frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), while addressing their limitations.

IFRS 1 - General Requirements for Disclosure of Sustainability-related Financial Information in particular it focuses on sustainability-related risks and opportunities that are useful to users of general purpose financial reports in making decisions relating to providing resources to the entity. This includes reporting on risks, opportunities, strategy and how organizations integrate sustainability into their decision-making and governance processes.

IFRS 2 - Climate Related Disclosures sets out specific requirements for disclosing climate-related risks and opportunities such as physical risk and transitional risk, while also evaluating the process of oversight and decision making demonstrated by a company. These metrics ensure comparability and consistency across industries, allowing stakeholders to evaluate and benchmark sustainability performance more effectively.

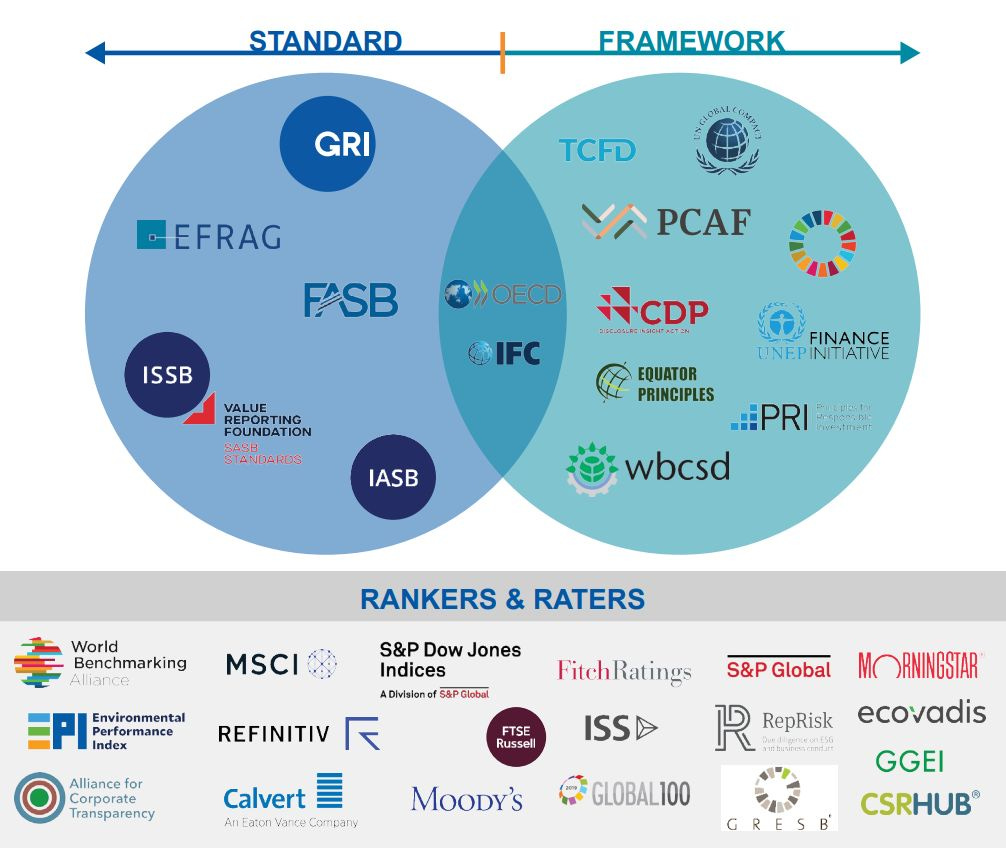

The release of IFRS 1 and IFRS 2 has significant implications for global reporting. The standards enable consistency and comparability in sustainability reporting across countries, industries, and organizations, as well as accountability and transparency. By providing a standardized framework, IFRS 1 and IFRS 2 facilitate better assessment, benchmarking, and decision-making for investors, regulators, and other stakeholders, and provide a more streamlined understanding in what sometimes feels like a sea of acronym soup. Knowing that the standards have been built in consideration of the greater landscape enables to effectively use this standards in tandem with geographically significant frameworks and global frameworks such as the GRI.

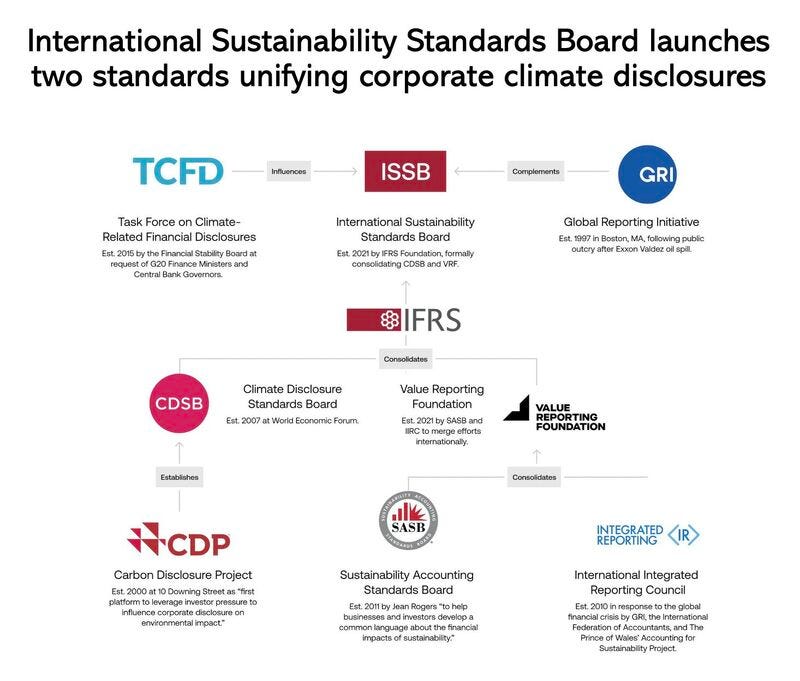

This landscape of sustainability reporting standards and regulatory bodies has evolved over several decades, reflecting a growing recognition of the need for organizations to account for their environmental, social, and governance (ESG) impacts. Including the This landscape of sustainability reporting standards and regulatory bodies has evolved over several decades, reflecting a growing recognition of the need for organizations to account for their environmental, social, and governance (ESG) impacts. Including the Global Reporting Initiative (GRI); United Nations Global Compact (UNGC); Task Force on Climate-related Financial Disclosures (TCFD): Sustainability Accounting Standards Board (SASB); International Integrated Reporting Council (IIRC) and the Climate Disclosure Standards Board (CDSB). Read more on the standards here.

The new sustainability reporting standards build upon and work within this historical context of existing frameworks and regulatory bodies in several key ways:

Harmonization and Consistency: The new ISSB standards aim to harmonize and provide a common language for sustainability reporting. They take into account the best practices and lessons learned from existing frameworks like GRI, SASB, and CDSB. By aligning with these established frameworks, the ISSB standards ensure consistency and comparability of reported sustainability information across organizations and industries. This alignment helps to streamline reporting efforts and reduces the burden on organizations that previously had to navigate multiple reporting frameworks.

Complementarity and Integration: The new standards do not seek to replace existing frameworks but rather complement and integrate them. Recognizing the diverse needs of stakeholders and industries, the ISSB standards build upon the foundation laid by frameworks like GRI, SASB, and TCFD. They provide a comprehensive reporting framework that encompasses both general disclosures and specific metrics. This integrated approach allows organizations to provide a more holistic view of their sustainability performance, considering environmental, social, and governance aspects alongside financial reporting.

Stakeholder Engagement and Materiality: The historical context of sustainability reporting has emphasized stakeholder inclusiveness and materiality. The new ISSB standards maintain this focus by requiring organizations to engage with stakeholders and identify the sustainability issues that are most material to their business. By integrating stakeholder feedback and determining materiality, organizations can report on the ESG topics that are most relevant to their operations and that have a significant impact on their long-term value creation.

Addressing Emerging Challenges: The historical development of sustainability reporting frameworks has been driven by evolving global challenges. The new ISSB standards reflect this ongoing evolution by addressing emerging sustainability issues, such as climate change, resource usage, and social impact. They incorporate recommendations from initiatives like the TCFD, which highlight the need for organizations to disclose climate-related risks and opportunities. By aligning with and building upon these evolving frameworks, the ISSB standards ensure that organizations can report on the most pressing sustainability challenges of our time.

Enhanced Transparency and Accountability: The historical context of sustainability reporting has been shaped by the growing demand for transparency and accountability from stakeholders, including investors, regulators, and the public. The new ISSB standards reinforce this need by providing comprehensive reporting requirements that enhance transparency and enable stakeholders to assess an organization's sustainability performance more effectively. By establishing a standardized framework, the ISSB standards contribute to greater accountability, allowing organizations to demonstrate their commitment to sustainable practices and meet the expectations of their stakeholders.

As businesses gear up to understand and embrace the newly released IFRS sustainability reporting standards, the first step has to entail familiarizing themselves with their own sustainability realities and recognizing where sustainability fits into their strategic puzzle. This has been a long time in the making and could be what kicks off a rapid adoption of regulatory implementation of company sustainability reporting requirements in the US and Canada, and well beyond.

If there is one thing that is clear now - we finally have globally recognized standards to guide these conversations! So, grab your compass and join us on this adventure towards a greener and more sustainable future!

Some further reading on the new standards:

- Emanual Faber on the new standards and how to apply them.

- Explore the new ISSB Global Sustainability standards directly.

- The new standards are not mandatory in Canada, but they could be - Fasken

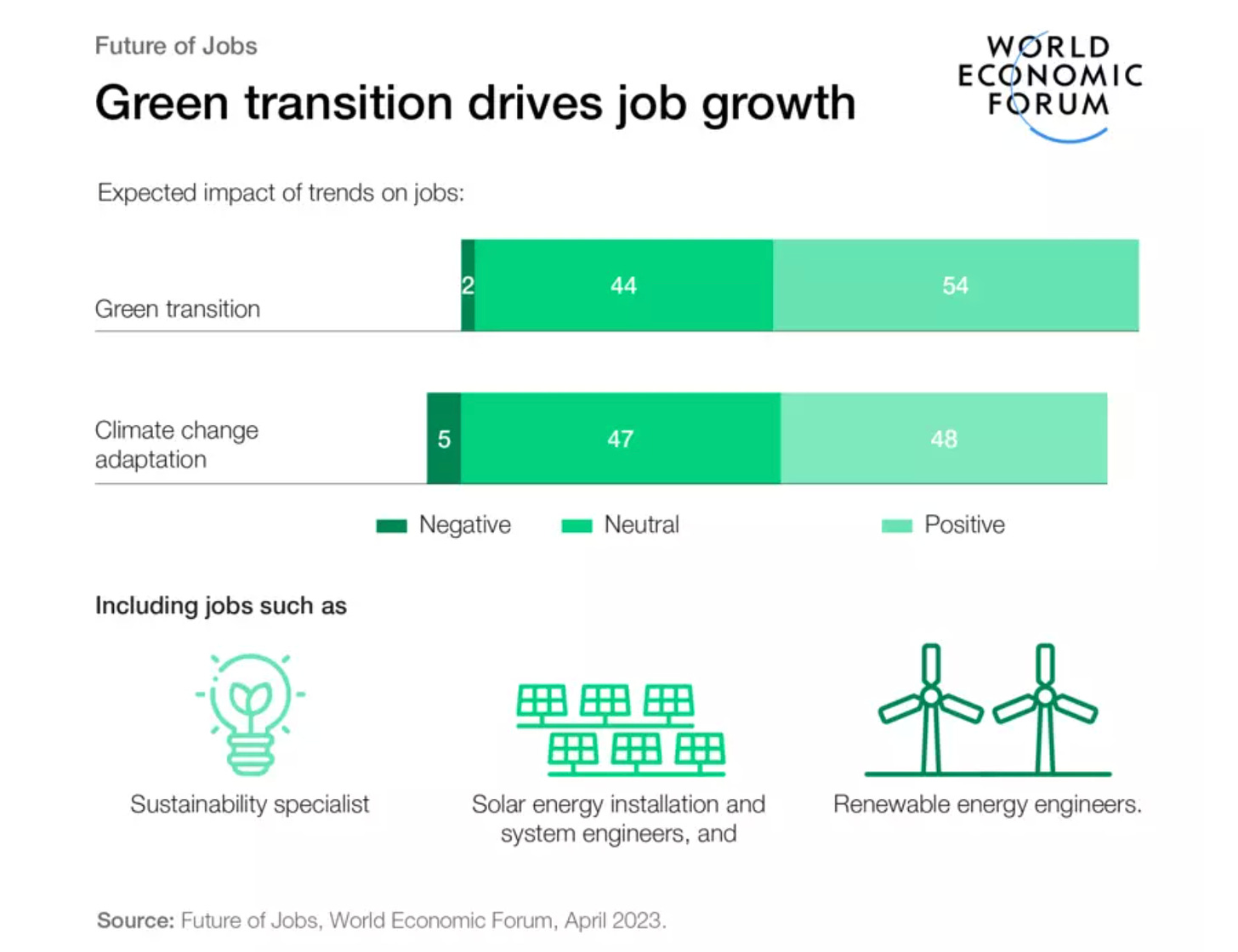

Green Transition Drives Job Growth

The green transition is driving key new skills and jobs in sustainability around the globe.

Why is this important? Whether you are in tech or product or services - green skills and knowledge are essential to being resilient in the future as leaders, employees, educators, and job creators. More on approaches to mitigating the sustainability skills gap can be found here.

Read the full Future of Jobs report by the World Economic Forum, exploring employer expectations to provide new insights on how socio-economic and technology trends will shape the workplace of the future. Report and key findings.

Watch and Listen

Watch CO2 Build Up in Our Atmosphere

We know its here, we know its one of the drivers of human caused global warming, but we can't see it with our eyes. NASA has produced a visualization for us to actually see. 'The videos show CO2 emissions from a range of sources: human-caused burning of fossil fuels (yellow); human-caused burning biomass (red); land ecosystems (green) and the ocean (blue). The pulsing squares indicate the absorption of CO2 by land ecosystems and the ocean.' Watch below or read more here.

Doughnut vs the Super organism

Really enjoyed this podcast episode with Doughnut Economics founder Kate Raworth discussing alternative economies that measure more than just the material wealth created by a society. Listen here.

Asking the big questions about our relationship with nature

What role do stories play in addressing climate change and biodiversity loss? Can we tell a new, but old, story about humans and nature that will reshape our world for the better? These are some of the questions nthat Damon Gameau grapples with in his Ted Talk and his documentary 2040

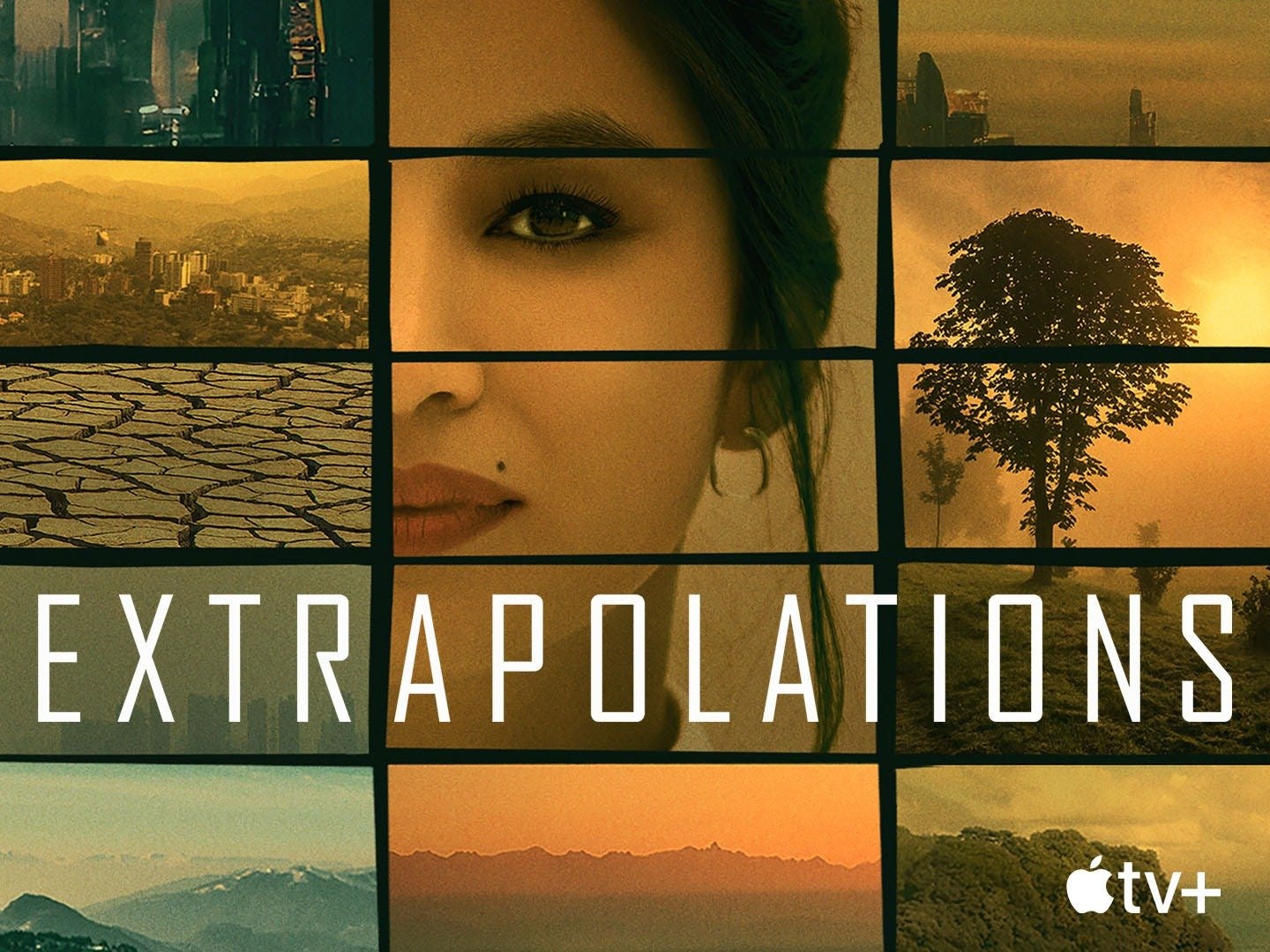

Extrapolations

The new climate change drama runs on Apple TV, tapping into the every day life impacts of climate change over the next several decades. It received mediocre reviews and an interesting take on why its so hard to make movies and shows about climate change.

In the News

Canada Offers Lesson in the Economic Toll of Climate Change - New York Times

Ford opens first carbon neutral plant - ESG Today

Macro economic freeze chills climate tech - CVTC

A new Circular Innovation Playbook 'Stuff in Flux' released - Circular Citizen

Time for private equity to move beyond ESG compliance - CCI

Orange County sues fossil fuel companies over heat dome - New York Times

Ecological tipping points could occur much sooner than expected - Guardian

Using advertising to combat climate change - Plan A

The need to value Earths foundational asset - ethic.com

Shippings' dirty secret - Guardian

Guide on adopting a Circular Approach in Your Business - Synergy Foundation

Canadas' fastest growing green companies - Corporate Knights

No Comments.